100 Percent Financing Mortgage Loan Credit Union

Table of Content

There are very specific requirements/restrictions for this program. Surviving spouses are typically eligible for a VA home refinancing as well. Credit scores and income requirements are more flexible VA mortgages than with conventional home loans. So, take some time to comb through your budget to determine what size mortgage payment you can comfortably afford.

You probably want to know how our 100 percent home loan finance setup works and what the benefits and downsides of it might be to you. In which case, keep reading because we’ll cover all of those questions and more. All origination, servicing, collections and marketing materials are provided in English only. As a service to members, we will attempt to assist members who have limited English proficiency where possible. Military images used for representational purposes only; do not imply government endorsement.

FAQ about 100 Percent Mortgage Financing

Should an emergency arise, you’ll just need to do a transfer from your home equity line of credit in online banking and you’re covered. Since these USDA mortgage loans are directly written and funded by the USDA, applications are accepted and processed through local Rural Development Service Centers. Each state page has full details for the Direct Loan program, updated interest rate information for it and contact information. Consent is not required to purchase goods or services from lenders that contact me.

Please be aware that you are linking to a website not affiliated or operated by the credit union. Rivermark is not responsible for the content of this website. Privacy and security policies may differ from those practiced by Rivermark. If you're looking to refinance your home, but have low equity, this could be a good option for you. Our field of membership is open to the armed forces, the DoD, veterans and their families. Servicemember Specials Take advantage of our military exclusives, offering low rates, special offers and discounts for those who have served.

Best Hard Money Loans for Real Estate Investors

There are still popular 100% mortgages that allow borrowers to receive money to refinance debt, student loans, pay off medical collections and more. This is not a no credit check mortgage option as credit scores are important for most equity loan programs in 2018. Nationwide is proud to announce more than 100 mortgage financing options for applicants in all 50 states.

You can see a state-by-state list of USDA Loan Limits, which are updated annually. The USDA defines "rural" generously -- you don't have to buy a home in the farm belt to qualify. In fact, the vast majority of the land area in the U.S. falls within this definition of rural. The rural designation includes many small- to medium-sized towns as well as suburban areas outside larger cities. The USDA offers a USDA property eligibility lookup tool to determine a given property's eligibility. In addition to this, the property you are buying must be in an eligible rural area.

Navy Federal

These are short-term loans so you may not even have to make monthly payments if you sell the investment property quickly enough. Our total loan can never exceed 60% LTV on new construction, home improvement loans or 60% of the purchase price . This is because private investors can approve your loan request based primarily on real estate equity with little or no red tape. (Sometimes 50% LTV on spec home construction loans and 25% to 35% LTV on land loans). USDA loans don't actually have a required minimum credit score, but lenders offering these loans typically require a credit score of 640.

Typically, home equity loans are only taken out against a certain percentage of available equity, meaning that there is still some equity available, but not being used. But, with the 100% loan-to-value, you’re able to access all of the available equity in your home, which gives you access to more funds, should you need them. The interest rate is set by HCFP based on the government's cost of money. Loan terms are 33 years, except for borrowers who earn less than 60 percent of the area median income, who can have terms of up to 38 years to make the loan more affordable.

On what day of the month is my first mortgage payment due?

Our Choice % financing conventional mortgage option has some great benefits for home buyers who qualify for a mortgage but don't have the available savings for a down payment. By purchasing a home with no down payment, you may be able to get the home you want sooner without waiting years to save for your down payment. Most lenders require mortgage insurance unless you can make a down payment of 20%.

This type of financing is better for someone who’s done this before, rather than someone who’s going into it cold. A personal line of credit, similar to a HELOC, might be a better idea if you don’t have a home to use as collateral. It’s still a revolving line of credit, but you might face higher interest charges compared to a HELOC since it’s an unsecured line. It also means your credit score and credit history are more heavily scrutinized to see if you’re worthy of lending money to. Many hard money lenders won’t give money to borrowers if it’s their first time flipping a house.

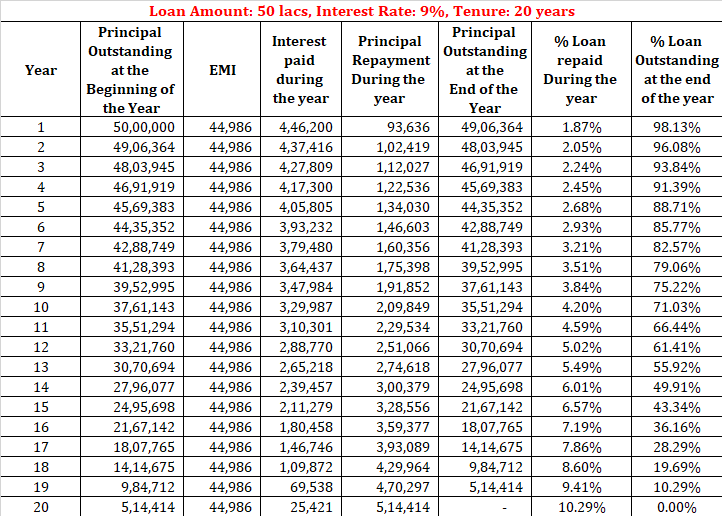

As required by the National Credit Act, all home loans are granted subject to the applicant’s affordability and credit status. This will determine the percentage loan one qualifies for as well as the interest rate offered. A home loan is a boon in such cases and buying or constructing a house with 100 percent home loan is the dream of every first-time home buyer. AmeriChoice recently started offering home equity loans for 100% loan-to-value.

Although you’ll need to meet certain eligibility requirements, a home buyer grant could open the door to homeownership. A 100% loan provides the entire cost of the home purchase upfront. With that, you won’t have to make a down payment to obtain the loan. Another niche offering from the Department of Housing and Urban Development is the Good Neighbor Next Door loan. Teachers, police officers and some other public employees can buy a home with just $100 down. There are programs that make it possible to buy a home without a down payment, like USDA and VA loans.

So, choosing the funds becomes elementary and more so when it is about buying a dream home. How many times have you had multiple deals in the works but found yourself short on capital for the next great opportunity? Allowing you to close on deals you previously had to pass on and ultimately allowing you to close on more deals and increase profits.

The only option with the USDA is the 30-year no down-payment loan and the interest rate must be fixed. Many lenders, banks included, will grant 100 percent financing for applicable mortgages. Each lender has their own requirements, but you’ll typically need a credit score of 580 or higher to qualify for 100 percent mortgages, like VA and USDA mortgages.

Comments

Post a Comment